Financial Warfare: Money Laundering in Private Equity

How the Federal Reserve, asset managers such as BlackRock, and Venture Capitalist directly led to the collapse of Silicon Valley Bank.

Peter Thiel Spurs a Bank Run on WhatsApp

On March 10, 2023, Silicon Valley Bank (SVB) failed after a bank run, marking the third-largest bank failure in history of the United States. Channels like messaging platform WhatsApp, email chains, texts and other closed forums were full of chatter over the bank’s financial issues well before those fears showed up Twitter.1

Peter Thiel's Founders Fund reportedly told companies in its portfolio to move their money out of SVB. Founders Fund had no cash left in Silicon Valley Bank by the time the bank failed. Thiel was the first outside investor along with Yuri Milner.2 Milner, a Russian Israeli investor, in Facebook, Twitter, WhatsApp and worked at the World Bank in Washington, D.C., in the early 1990s. WhatsApp was founded by Ukrainian Jan Koum, who just so happened to find his “Jewish roots” in order to become a major donor to Israel and Chabad Lubavitch.

During a Senate Finance Committee hearing, Sen. Mark Warner (D-Va.) placed blame on venture capitalists for coordinating their bank withdrawals over social media and online group chats.

“I’ve been supportive of the venture capital community — I was a venture capitalist before — but I think there were some bad actors in the VC community who literally started to spur this run by virtually crying fire in a crowded theater in terms of rushing all these deposits out,” Warner stated. “I’m not sure what regulatory system anywhere, no matter how much capital and how many stress tests that would have protected any institution from a $42 billion bank run in a single day.”3

Killer Whale Crisis

John Titus argues in his Best Evidence Substack and YouTube video that the sudden departure of personal whale bank accounts over the $250K FDIC—not business bank accounts—that tanked the banks.

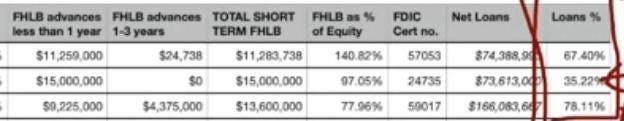

Silicon Valley Bank, Signature Bank and First Republic bank all borrowed massively from Federal Home Loan Board (FHLB) banks and most had to be repaid in less than a year.

Signature Bank owed $11.3 million in less than a year.

SVB owed $15 million in less than a year.

First Republic owed $9.2 million in less than a year and $4.3 in 1-3 years.

The mainstream media’s excuse that it was low interest loans that caused the failure doesn’t pass the smell test. The loans for the 3 banks ranged from 35%-78%

The massive withdrawal of these killer whale venture capital accounts and major venture capitalist like Founders Fund telling their companies to take their money out caused the bank run and the resulting banking collapse.

Check out Best Evidence: Deep Diving the Fed's Killer Whale Crisis

BlackRock Knew of SVB’s Risks

In October of 2020, SVB hired BlackRock’s Financial Markets Advisory Group to analyze the potential impact of various risks on its securities portfolio and even expanded the mandate to examine the risk systems, processes, and people in its treasury department, which managed the investments.

The January 2022 risk control report gave the bank a “gentleman’s C”, finding that SVB lagged behind similar banks and was “substantially below” them on 10 out of 11.4

Global asset management giant BlackRock gained approval to set up a wholly owned asset management business in China. U.S. mutual fund giant Vanguard is also moving its Asia headquarters to Shanghai in the next six months to two years.5 I find the possibility that certain tech elites thought using financial warfare to achieve their geopolitical goals is more likely. Especially ones that are financially aligned with China.

During the Global Financial Crisis quantitative easing (QE) was a direct bailout of the banks, whereas QE during the pandemic the Federal Reserve bought assets from non-bank financial institutions like BlackRock.

Using graphs from the Fed’s own FRED website, BestEvidence videos demonstrated “that U.S. bank deposits increased in lockstep with the Fed’s balance sheet. That’s because for every new dollar created by the Fed to buy something from a non-bank, somewhere there’s a commercial bank that has to create a new deposit account dollar in order to make that purchase happen.6

The Federal Reserve and BlackRock directly led to the creation of Killer Whale accounts that caused the collapse of those banks.

FBI “Blue Leaks”

(Image: FBI Report Reveals Private Equity Under Enhanced Money Laundering Scrutiny)

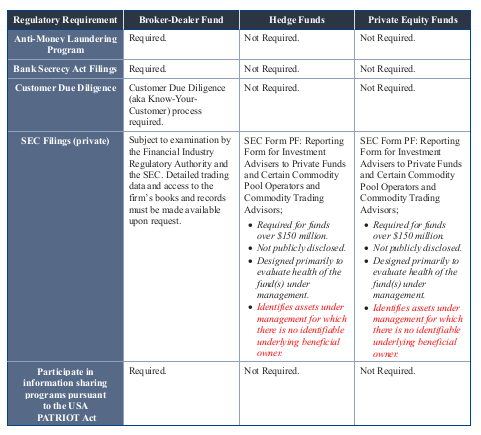

The U.S. Federal Bureau of Investigation believes firms in the nearly $10-trillion private investment funds industry -hedge funds, private equity and venture capital- are being used as vehicles for laundering money at scale, according to a 2020 leaked FBI intelligence bulletin. “Criminally complicit investment fund managers likely will expand their money laundering operations as private placement opportunities increase, resulting in continued infiltration of the licit global financial system. If greater regulatory scrutiny compelled private investment funds to identify and disclose to financial institutions the underlying beneficial owners of investments, this would reduce the appeal of these investment firms to threat actors, at which time the FBI will re-visit this assessment,” according to the FBI.7

PE [private equity] vehicles are illiquid, with long investor lockups being a signature of the asset class. Both asset classes cater exclusively to institutional clients and accredited investors, or people whose net worth exceed $1 million.

“Over the last several years, hedge funds have fallen out of favor among many institutional investors, while private equity funds and other private markets vehicles have continued to grow in assets under management,” said Bryce Klempner, a partner at consultants McKinsey & Company in Boston.8

Venture capital (VC) firms are higher risk enterprises from speculative investments to the misuse of investor funds. In 2015, a Treasury Department risk assessment estimated that around $300 billion is generated each year from illicit money which can then be funneled through laundering operations to finance organized crime or terrorist networks.9 Although VC investments tend to be long-term and illiquid, they can still be used to shelter illicit proceeds or to fund illicit ventures.

Venture-Based Money Laundering in Web3

Criminals have always found efficient ways to launder the proceeds of their crimes and avoid increasingly stringent anti-money laundering regulations on traditional banks. One such technique, poses a direct threat to Web3 projects, is where criminal organizations are using this scheme to transform their illegal funds into seemingly legitimate Web3 startups and reap high returns.

Criminal organizations use Venture-Based Money Laundering (VBML) is the manipulation of venture seed funding to convert criminal proceeds into legitimate businesses and revenue streams through seed investment in early-stage ventures.

Applied to the Web3 context, VBML consists of criminals’ seed-funding a new crypto project with “dirty” funds. This initial seed funding is used to hire developers, invest in marketing, and launch the project. The criminals spend the entirety of the illegal funds on these expenses and in return, own or co-own a productive Web3 project. From here, they can obtain "clean money" that is easily justifiable because they have a publicly known business to show as the origin of the funds. The "clean money" can be extracted multiple times throughout the life cycle of the project, such as during following fundraising rounds, token or NFT sales, payments for salaries, expenses, dividends, and when the criminals sell their project ownership…

In some instances, the investigations revealed that the real project founders and owners were using deceptive tactics to hide behind a front team and were directly linked to criminal activities such as previous exit scams, various crypto scams, and even international drug trafficking.10

Capitol Hill Pushes the U.S. Treasury Department

The economic sanctions on Russian oligarchs over Vladimir Putin’s invasion of Ukraine has exposed a loophole that prevents regulators from tracking offshore money into the United States: Hedge funds, private equity firms, family offices and venture capital.

Lawmakers are calling on the Securities and Exchange Commission and the Treasury Department to require firms in the $11 trillion private funds market to do the same kind of “know your customer” and anti-money laundering checks performed by financial institutions including banks, brokerages, mutual funds and even casinos.

Senators Elizabeth Warren of Massachusetts and Sheldon Whitehouse of Rhode Island said closing the loophole would “help the U.S. government track down the hidden wealth of sanctioned Russian elites and better combat money laundering, terrorism, the proliferation of weapons of mass destruction and other criminal activity throughout our financial system.”

“Right now, broker-dealers, mutual funds and banks are legally required to understand who their clients are and evaluate the source of their clients’ funds before investing them but hedge funds, private equity and venture capital funds don’t — which doesn’t make any sense.” said Elise Bean, former staff director and chief counsel of the Senate Permanent Subcommittee on Investigations, who has specialized in money-laundering investigations.11

Bean is advising a coalition of more than 100 organizations that filed a letter with the S.E.C., saying regulators should require private equity to provide regulators with a list of all the “beneficial owners” of the money they accept from investors and to identify the countries where those investors reside.

Geopolitics of Finacial Warfare

Who was warned about the collapse of the Silicon Valley Bank before it happened?

Israel

“Israel’s two largest banks, Bank Leumi and Bank Hapoalim, set up a situation room that has been operating around the clock to help firms transfer their money from SVB — before it was seized — to accounts in Israel,” reports the Times of Israel.

“Over the past few days, teams at LeumiTech, the high-tech banking arm of Bank Leumi, have been able to help their Israeli clients transfer about $1 billion to Israel, the bank said.”

Israel is the cybertechnology juggernaught that funds the Talpiot Program that trains IDF soldiers in cybersecurity and places them as CEOs all over the world. After Jeffrey Epstein’s connections to the Mossad, Israel, Russia, sex trafficking, money laundering, and blackmailing American technology elites like Bill Gates. We have to ask how much of the venture capital that was pulled from the failing banks was money laundering?

Both Bank Leumi and Bank Hapoalim have been charged with money laundering in the past and thanks to the impeccable reporting by Jewish Israeli and Jewish American journalists we know that Russian Mafia, KGB, SRU, and GRU have penetrated the Russian government like Israeli politician Avigdor Lieberman. We also know from former President Trump that “Putin Is a Great Believer in Israel, He Is a Fan of Bibi.”

(Image: Avigdor Lieberman and Vladimir Putin)

WikiLeaks Cable: Russian Leadership Viewed Lieberman as 'One of Its Own' - Haaretz Com - Haaretz.com

U.S. government documents reveal that JPMorgan Chase, HSBC and other big banks have defied money laundering crackdowns by moving large sums of illicit cash for criminal networks that undermine democracy.12 U.S. law enforcement rarely prosecute megabanks that break money laundering laws. The Pandora Papers documents the international web of offshore unregulated financial centers were established for the primary purpose of facilitating money laundering and many of the major banks dominating these centers were the original British and American opium financiers. Obviously, the British and American banking establishment has never gotten out of the opium business or human trafficking, nor have they been held accountable for their crimes.

-D.C.

I need to read this 6 more times to absorb everything I just read! How are you this good?! The info here is so dense! You truly are a light in the darkness. 💛💛💛

Excellent work!